Investors are turning an eye back toward manufactured housing communities and RV resorts in metro Phoenix.

GlassRatner Advisory & Capital Group LLC recently sold the 252-acre Meridian RV Resort in Apache Junction for $11.6 million to Equity LifeStyle Properties Inc., a Chicago-based real estate investment trust.

NorthMarq's national manufactured housing team of Don Vedeen, Jared Bosch and Chris Michl represented the buyer and seller in the deal, which closed on Dec. 14.

Vedeen, vice president of NorthMarq, said his team retained the asset out of receivership, generating more than 13 offers before the Chicago REIT snatched it up.

Over the past few years, manufactured housing communities, or MHCs, have made their way into the spotlight, he said.

"With a national lack of affordable housing and consistency in the asset class, investors have been searching for opportunities to enter the market," Vedeen said. "This year, there was some hesitancy during the initial Covid-19 outbreak, however the MHC industry showed collection rates much higher than other asset classes, such as retail and office."

During these uncertain times, investors are looking for opportunities to find yield while staying fairly safe, he said.

"Manufactured housing and RV communities have long been touted as recession resistant, and I think that this year has further proven that to be true," Vedeen said.

In September, Washington, D.C.-based private equity giant The Carlyle Group Inc. (Nasdaq: CG) paid a record-breaking $88 million for an RV resort in Apache Junction with 1,119 spaces.

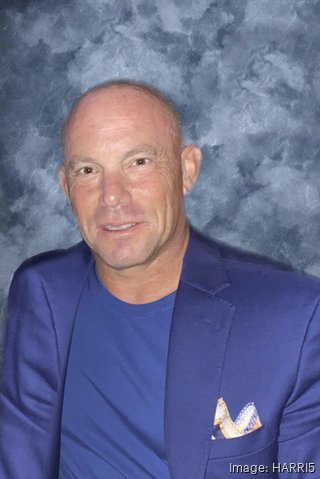

That deal was brokered by Derek Harris, founder and principal of HARRI5, a Scottsdale manufactured housing and commercial brokerage.

Then in October, Harris brokered another deal, where The Carlyle Group paid $32 million for Peoria Mobile Estates in Peoria and Imperial Broadmoor in Mesa.

Harris said he is seeing unprecedented interest in the RV resort space from institutional investors in Arizona and across his national platform.

His brokerage has more than $50 million of RV resort communities in escrow that are set to close in 2021.

"I expect this will continue to be the fastest growing segment of the MHC/RV space for institutional investors," Harris said.